cumulative preferred stock formula

New Look At Your Financial Strategy. Preferred stocks typically have fixed dividend payments based on the stocks par value.

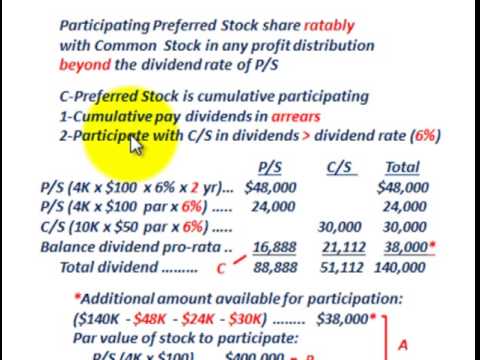

Preferred Stock Non Cumulative Partially Participating Allocating Dividends To P S C S Youtube

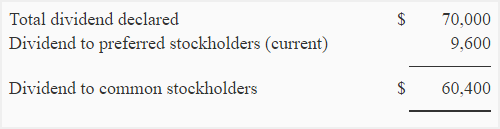

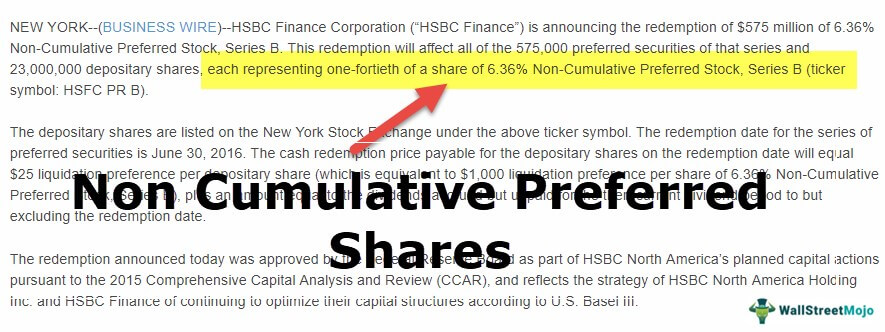

If the preferred stock is noncumulative.

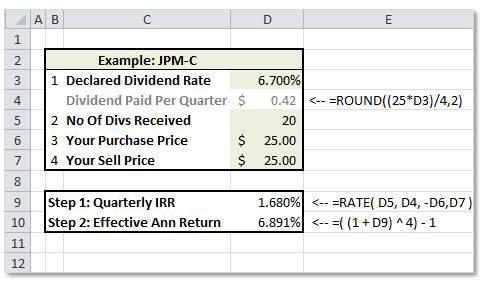

. Stock dividends are usually paid in quarterly installments so your next dividend payment will be. The corporation has not paid dividends in the current or past two years. Cost of Preferred Stock Formula Cost of Preferred Stock Preferred Stock Dividend Per Share DPS Current Price of Preferred Stock Similar to common stock preferred stock is typically assumed to last into perpetuity ie.

The formula in such. Rate of dividend 3 100 003. Dividends are paid out regularly such as quarterly or annually.

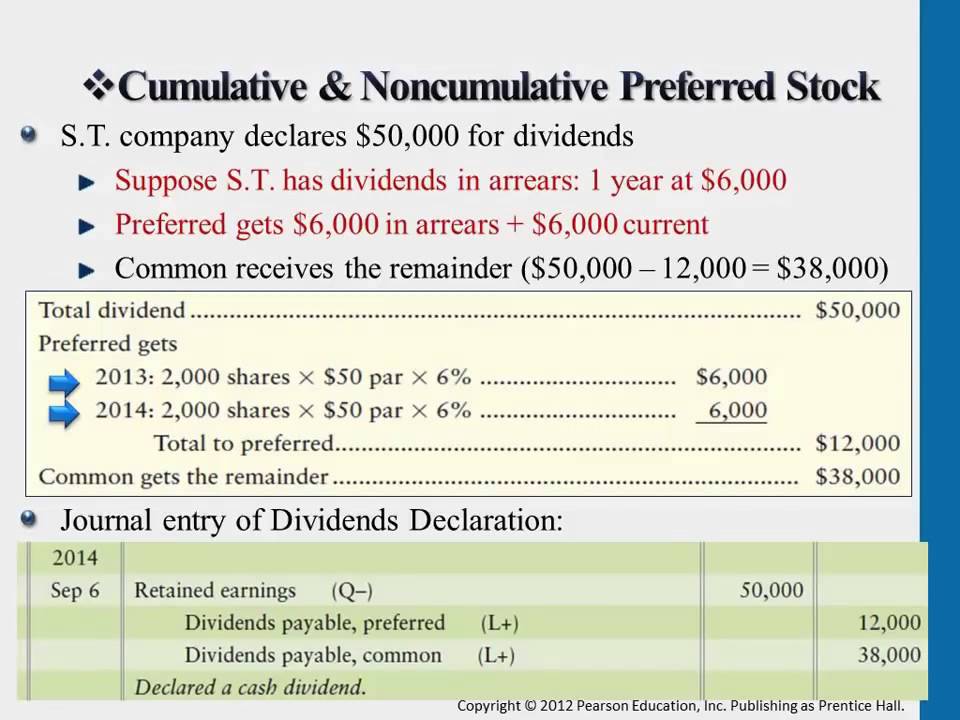

Cumulative Dividend 5 x 100 5 Dividend per preferred share Since Colin is looking to purchase 1000 preferred shares he would be entitled to 5000 annually. In other words par value is the face value of one share of stock. In this case the cumulative dividend on 6 preferred stock will be paid first to preferred stockholders and the remaining amount will then be deemed available for distribution to common.

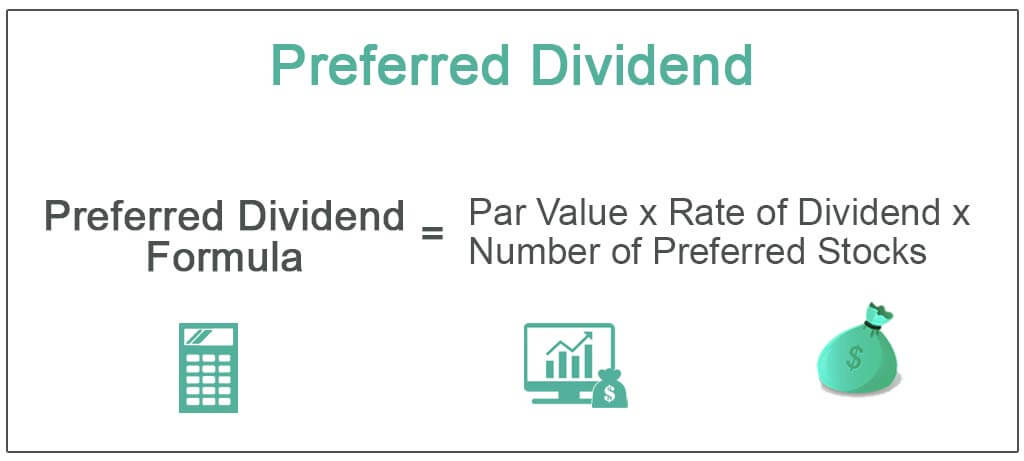

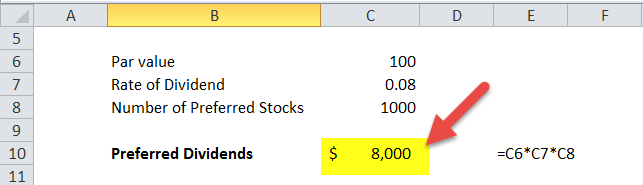

Preferred dividend Par value x Rate of dividend x Number of preferred stock. To Cumulative preference shareholders there is an obligation to pay them the dividends but a relaxation that it can be delayed or being partly paid. Where Preferred Dividend Rate The rate that is fixed by the company while issuing the shares.

If your preferred shares pay a 6 dividend rate and have a par value of 25 you can determine the cumulative dividends with the three steps discussed above. Number of preferred stock 2000. Preferred shares during an economic downturn Colin recently purchased 1000 preferred shares of ABC Company.

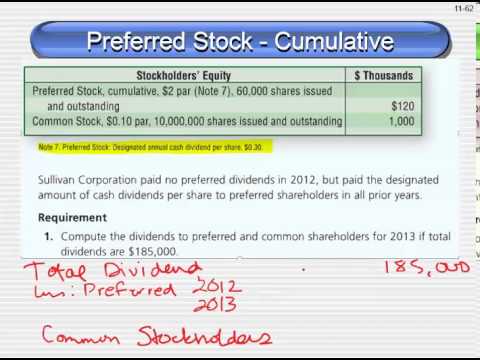

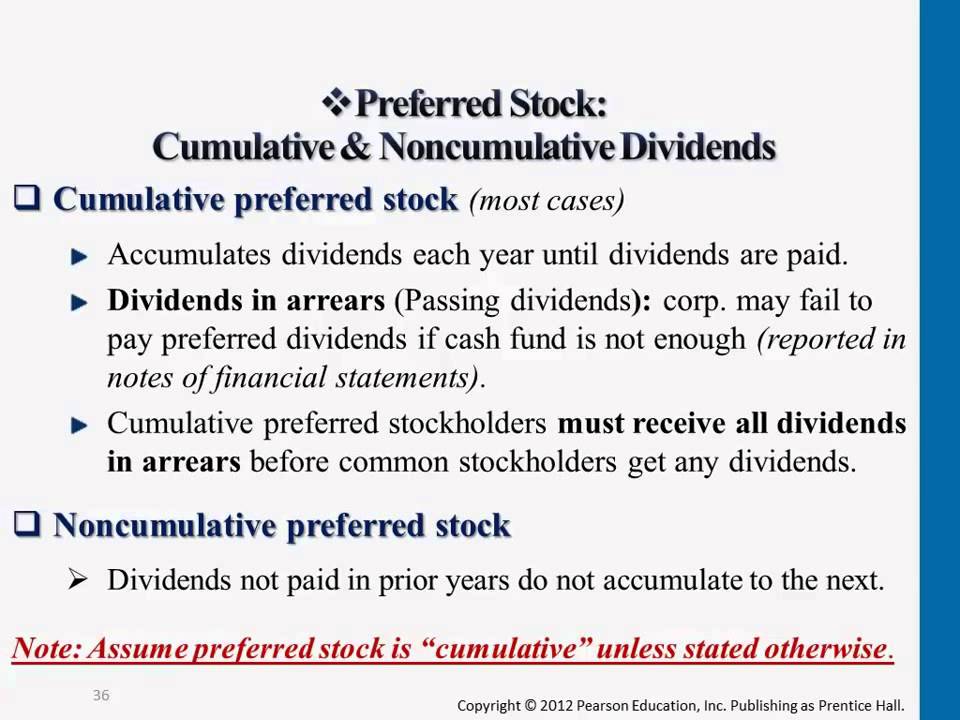

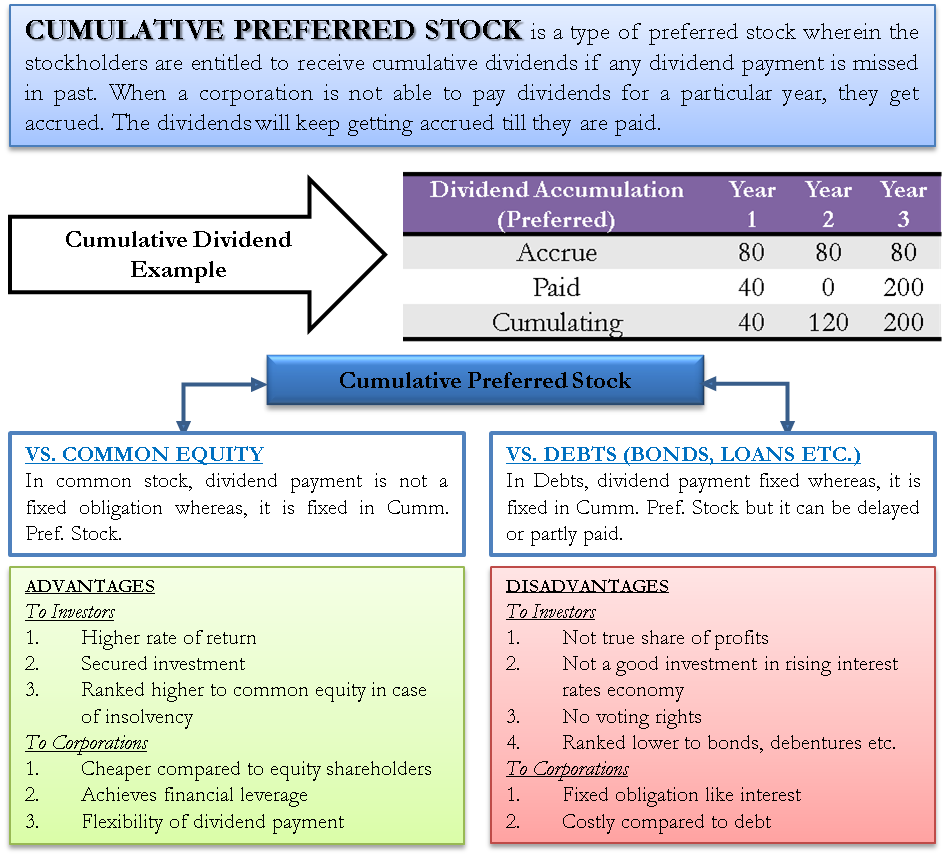

Cumulative Dividend Formula Preferred Dividend Rate Preferred Share Par Value. Thats a gain of 10 if the investor converts and sells the common shares. Cumulative preferred stock is a type of preference share that has a provision that mandates a company must pay all dividends including those that were missed previously to cumulative preferred.

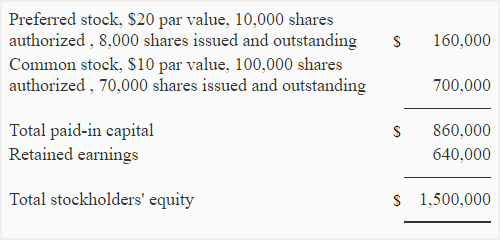

A company has preferred stock that has an annual dividend of 3. Ad With Best-in-Class Trading Tools No Hidden Fees Trading Anywhere Else Would be Settling. 160000 06 9600.

With an unlimited useful life and a forever-ongoing fixed dividend payment. Explanation of Preferred Dividend Formula Preference Dividend is the amount of money received from a company from its retained earnings every year to the preference shareholders for holding the preference shares. Annual Dividend Rate Par Value If the payment frequency is quarterly the dividend paid every quarter is Quarterly Dividend Annual Dividend 4.

What is the amount of. For example if the price is 40 per share and the annual dividend is 4 the rate would be 10 or 10. Heres an easy formula for calculating the value of preferred stock.

Dividend Formula The formula for calculating the dividend in these instruments is as follows. Rp D dividend P0 price For example. Find a Dedicated Financial Advisor Now.

Preferred Dividend 1500 007 150 Preferred Dividend 15750 It means that each year Anand will get 15750 preferred dividends. The formula could be reworked to find the rate or return by dividing the fixed dividend payout by the price. If the current share price is 25 what is the cost of preferred stock.

Preferred Dividend formula Par value Rate of Dividend Number of Preferred Stocks 100 008 1000 8000. This feature of arrear payment is only available with the cumulative preferred stock The Cumulative Preferred Stock Cumulative preferred stock is a class of shares wherein any current years unpaid or undeclared dividends. If the ABC common shares move to 110 the preferred shareholder gets 1100 110 x 10 for each 1000 preferred stock.

Rp D P0 Rp 3 25 12 It is the job of a companys management to analyze the costs of all financing options and pick the best one. Suppose cumulative preferred stock with a 10 dividend rate and a 1000 par has been issued. Cumulative preferred stock is preferred stock which pays cumulative dividends if a dividend payment is missed.

For example suppose you own 1000 shares of Company X cumulative preferred stock. As referenced above cumulative preferred stock is a type of preferred stock. Preferred cumulative stock Vs Debt.

Par value 20. See how to calculate the Cost of Preferred Stock to a corporation. Each share has a par value of 100 and a dividend rate of 8 percent.

Preferred Shares A preferred share is a share that enjoys priority in receiving dividends compared to common stock. Find Todays Best Dividend Stocks Ex-dividend Dates and Stock Data. If the preferred stock is cumulative.

If they were issued at 20 per stock at 3 dividend rate we can calculate what she is expected to get as dividends using the preferred dividend formula. Ad Do Your Investments Align with Your Goals. Dividend formula of Cumulative preference shares.

Return to Top Formulas related to Preferred Stock PV of Perpetuity Perpetuity Payment Perpetuity Yield PV of Preferred Stock Calculator. Visit The Official Edward Jones Site. Annual dividend on preferred stock.

Preferred share Par Value Preferred shares. Cumulative preferred stock contains a provision requiring that any missed dividend payments be paid out to. Rather in any kind of Debt it is mandatory to pay interest fee in the accrual year.

Quarterly dividend payment annual dividend 4. Ad Search Ex-Dividend Dates Dividend Calendar All-Star Rankings More. Cost of Preferred Stock Preferred Stock Dividend D Preferred Stock Price P.

Preferred Dividend Definition Formula How To Calculate

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

How To Calculate Cumulative Dividends Per Share The Motley Fool

Preferred Stock Cumulative Noncumulative Dividends Youtube

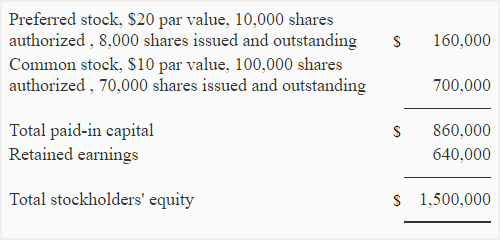

Common And Preferred Stock Principlesofaccounting Com

Retail Investor Org Nitty Gritty Ofpreferred Shares How They Work Investor Education

Cumulative Noncumulative Preferred Stock Youtube

Preferred Stock Investors What Is Your Rate Of Return Seeking Alpha

Accounting For Corporations Ppt Download

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Cumulative Preferred Stock Define Example Benefits Disadvantages

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Cost Of Preferred Stock Rp Formula And Excel Calculator

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Noncumulative Preference Shares Stock Top Examples Advantages

Preferred Shares Meaning Examples Top 6 Types

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management